Companies often make purchases from global suppliers or vendors, which could be one-off transactions or small volumes. They end up paying unnecessary FX fees for these transactions, dealing with manual processes, and struggling to reconcile these global transactions back to their ERPs, without any benefits for all their effort. Handling monthly recurring payments for software subscriptions in foreign currencies is another major hassle for companies that isn't talked about enough.

We’ve been working hard to solve this for businesses in North America, and we're super excited to launch corporate cards with Finofo!

You can issue unlimited virtual cards instantly from your Finofo platform, with zero waiting time and absolutely no annual fees. These cards are seamlessly integrated with your global Finofo accounts, enabling companies to spend globally, earn unlimited cashback on your card spend, and eliminate currency conversion fees.

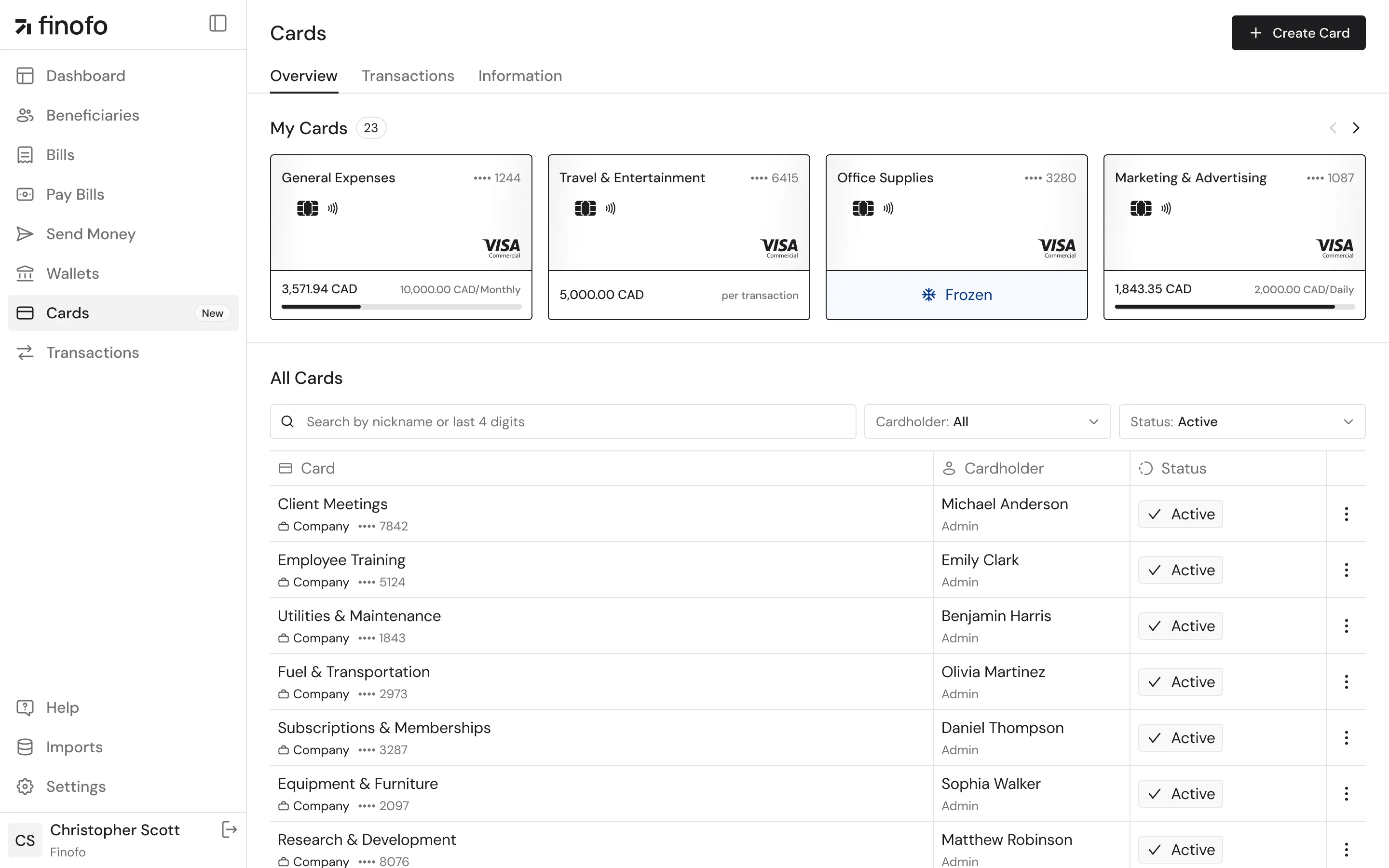

If you want to control large vendor spending or manage your recurring software subscription fees, you can create vendor-specific virtual cards to manage risk and maintain a single card for all transactions with those vendors. Alternatively, you can also issue single-use virtual cards for one-off international bills that need to be paid.

Once these cards are issued, you can set daily, weekly, and monthly transaction limits to ensure spending is kept in check. Not only that, it will make it easier for the accounting teams to automate reconciliation and gain total spend oversight of all transactions.

Card transactions can be funded through any of the ten specified currencies listed below. If funds in those currency wallets are insufficient for a transaction or if you spend in a currency not included in this list, funds will instead be drawn from your default currency accounts.

The Cards management page provides account admins with comprehensive details, including the cardholder's name, transaction status, date, amount, and merchant information. Every piece of information is meticulously recorded and easily accessible.

We aim to provide maximum flexibility in managing these cards. You can set specific limits per transaction to control spending on each individual purchase. Additionally, you can establish daily limits to cap the total amount spent in a single day, weekly limits to manage spending, and monthly limits to keep your expenditures in check for each month. For long-term control, you can also set lifetime spending limits to ensure that the total amount spent over the card's usage does not exceed a predetermined amount.

On top of this, you can temporarily freeze your card to halt any further transactions, giving you the ability to manage risk and security. If needed, you can also cancel your card at any time, offering you complete control over your financial operations.