In this article, we'll dive into what RBC PayEdge is, how it came to be, its features and services, and the platform's limitations. We'll also discuss if it's truly worth spending thousands of dollars on a tool solely for Accounts Payable.

RBC PayEdge is an accounts payable platform that automates payments to suppliers and is one of the offerings from RBC to Canadian businesses. It can be used by business of any size, even if they are not an RBC banking client.

In 2019, RBC acquired WayPay, a cloud-based payments fintech from Burlington, offering a solution for accounts payable automation. Originally launched in 2014, WayPay allowed businesses to connect to accounts payables platforms like Xero, Sage, and QuickBooks so they could automatically view, pay, and reconcile approved bills and invoices.

Six years since the acquisition, nothing has really changed with the application. Not even a minor advancement or upgrade. RBC did not take any steps to improve or upgrade the platform but merely rebranded it as RBC PayEdge and added it to their list of services.

PayEdge primarily offers Accounts Payable (AP) features, including managing new payments, importing bills, handling outstanding payables, and transfers. Additionally, it manages all supplier information associated with these bills. RBC PayEdge currently supports direct API connectivity with three cloud-based accounting platforms such as QuickBooks Online (QBO), Xero, and Sage Accounting.

RBC PayEdge has several limitations that make it a bothersome tool for users:

Here is the detailed pricing information from PayEdge:

Is it worth paying so much for an outdated and clunky accounts payable tool? Can PayEdge be used as an accounts receivable platform?

Definitely, not. PayEdge does not provide unique accounts to receive funds (CAD, USD or any other currency) from customers, vendors, or others. It is only an accounts payable platform with significant limitations and no accounts receivable capabilities.

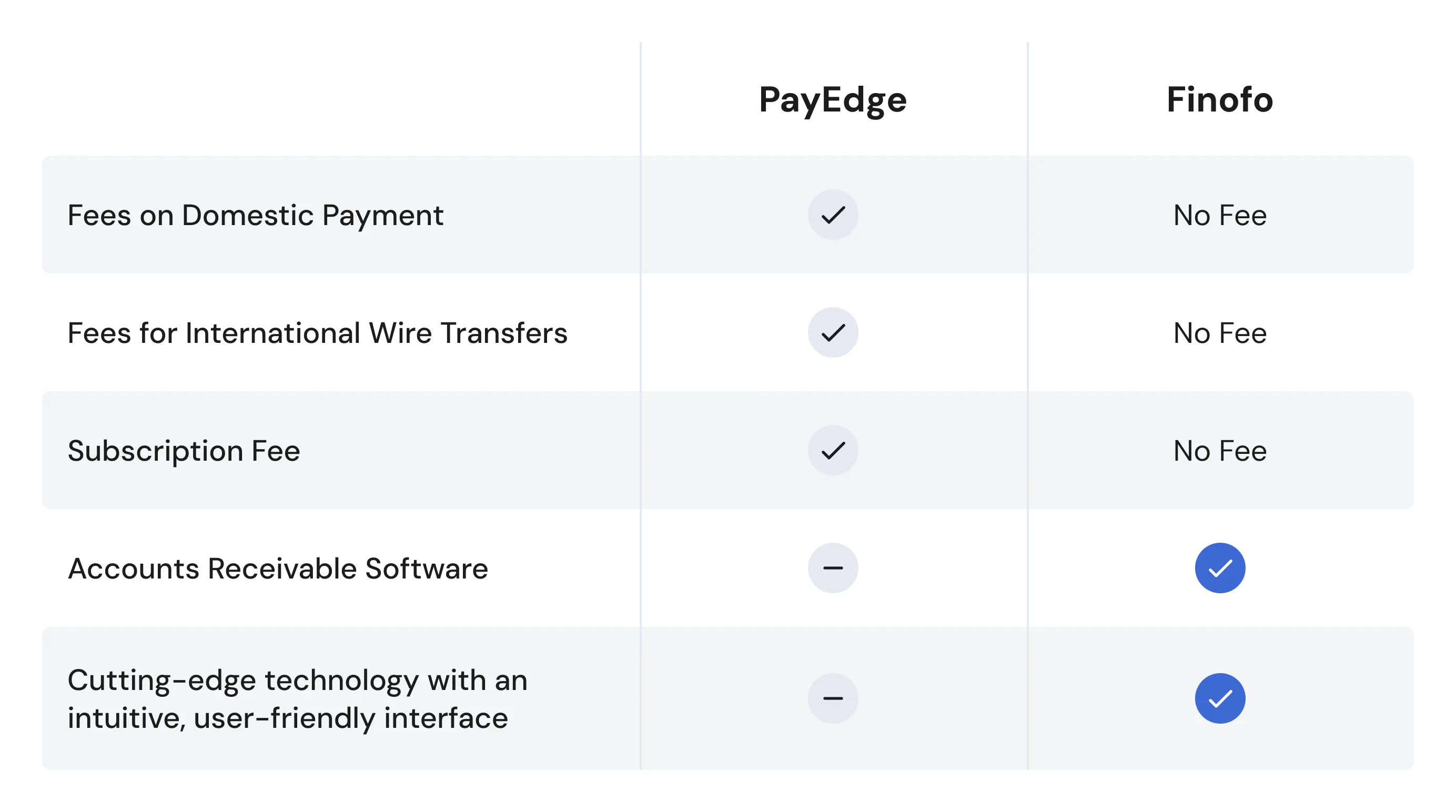

Finofo is a robust alternative to RBC PayEdge and RBC business banking. Beyond the unfavorable exchange rates with RBC, here is a quick comparison between the tools-

For businesses that sell internationally, Finofo acts as a seamless receivables platform. We provide unique account details in different currencies and locations, enabling your customers to pay you easily. This makes your business operate like a local player, receiving funds locally.

With Finofo’s accounts payable capabilities, you can connect your accounting software, streamline your bills, and send faster payments to global suppliers using real-time rails.

Avoid the limitations of RBC PayEdge and enjoy a seamless, efficient, and cost-effective global AP/AR experience with Finofo.

Get started with Finofo today!